Financing for U.S.-LATAM Cross-Border Trade

Discover the most effective financial strategies for U.S. and Latin American SMEs engaging in cross-border trade. Learn how to navigate the complexities of international trade finance and unlock new opportunities in the U.S.-LATAM corridor.

Infographic depicting key banks and financial institutions specializing in U.S.-LATAM trade funding.

Introduction

In the dynamic landscape of global trade, the relationship between the United States and Latin America (LATAM) stands as a beacon of potential and growth. Small and Medium-sized Enterprises (SMEs) in both regions are increasingly looking to cross-border trade as a gateway to new markets and diversified revenue streams. This blog post aims to shed light on the financial strategies and instruments that can facilitate this trade, focusing on the needs and opportunities for U.S. and Latin American SMEs.

Financial Instruments Facilitating Cross-Border Trade

Letters of Credit

Essence: Letters of Credit (LCs) offer a secure method of payment, crucial in building trust in international trade.

Impact on SMEs: LCs minimize the risk of non-payment, especially important for SMEs venturing into new markets.

Trade Finance Loans

Essence: These loans provide the necessary capital for SMEs to cover the costs of manufacturing and shipping goods before receiving payment.

Impact on SMEs: They ensure liquidity, enabling SMEs to take on larger orders and enter new markets without straining cash flow.

Export Credit Insurance

Essence: This insurance protects exporters from the risk of non-payment by foreign buyers.

Impact on SMEs: It gives SMEs the confidence to extend credit to new customers, crucial for competitive positioning in international markets.

Overcoming Trade Barriers

Understanding Regulatory Frameworks

Essence: Navigating the complex regulatory environments of different countries is vital.

Impact on SMEs: Knowledge of trade agreements and regulations can prevent costly legal issues and delays.

Leveraging Free Trade Agreements

Essence: Free Trade Agreements (FTAs) between the U.S. and LATAM countries can offer tariff reductions and other trade benefits.

Impact on SMEs: FTAs can significantly lower the cost of exporting or importing, making SMEs more competitive.

Technological Advancements in Trade Finance

Digital Payment Platforms

Essence: These platforms streamline international transactions, making them faster and more secure.

Impact on SMEs: Reduced transaction times and fees can enhance cash flow management and operational efficiency.

Blockchain in Trade Finance

Essence: Blockchain technology offers transparency and security in international transactions.

Impact on SMEs: It reduces fraud risk and improves trust, especially important for SMEs dealing with new international partners.

The Role of Banks and Financial Institutions in U.S.-LATAM Cross-Border Trade

Access to Diverse Financing Options

Essence: Banks and financial institutions offer a variety of financing options tailored to the needs of international trade.

Impact on SMEs: This access enables SMEs to choose the most suitable financing solution, whether it’s short-term trade finance, lines of credit, or long-term loans.

Advisory and Risk Assessment Services

Essence: Beyond providing capital, these institutions offer advisory services, helping businesses understand the risks and benefits of cross-border trade.

Impact on SMEs: SMEs can make informed decisions and navigate the complexities of international markets with expert guidance.

Facilitating Currency Exchange and Hedging

Essence: With trade often involving multiple currencies, banks play a crucial role in currency conversion and offering hedging instruments to protect against exchange rate volatility.

Impact on SMEs: Effective currency management is vital for SMEs to protect their profit margins and reduce financial risk.

Building Trust and Credibility

Essence: Having a reputable financial institution as a partner adds credibility, which is crucial in establishing trust in new international markets.

Impact on SMEs: SMEs can leverage their relationship with well-known banks to build confidence with overseas partners and customers.

Digitalization and Streamlined Processes

Essence: Many banks are embracing digital platforms to streamline trade finance processes, making them more efficient and accessible.

Impact on SMEs: Digital solutions reduce paperwork, speed up transactions, and enhance transparency, greatly benefiting SMEs in managing cross-border trade.

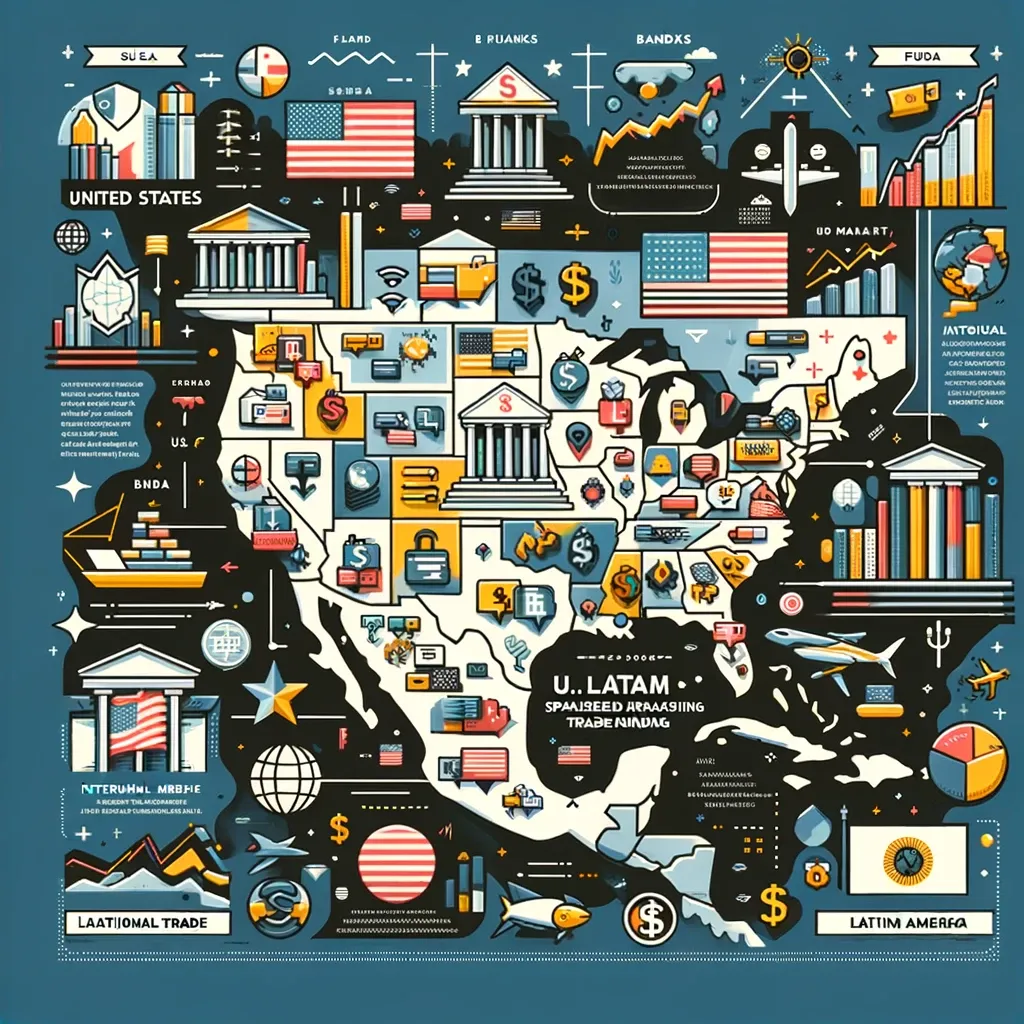

Key Financial Players: Spotlight on Banks and Institutions Fueling U.S.-LATAM Trade

Several banks and financial institutions specialize in U.S.-LATAM trade funding, offering various services to facilitate cross-border trade between these regions.

Here are some of the key players:

1. Credijusto: This Mexican fintech company specializes in lending to small and midsize businesses involved in U.S.-Mexico trade. Credijusto provides loans ranging from $5,000 to $1.5 million and has acquired Banco Finterra, a Mexico City-based bank that specializes in financing for small businesses and agriculture. This acquisition allows Credijusto to offer a more comprehensive range of products, including checking and savings accounts, credit cards, and financial management tools.

2. BBVA: A leading trade finance bank in Latin America, BBVA operates in Argentina, Brazil, Chile, Colombia, Mexico, Peru, Uruguay, and Venezuela. It offers global platforms such as Pivot Net and Pivot Connect, as well as Comext Online, a digital trade finance platform that includes offerings related to environmental, social, and governance (ESG) issues.

3. Santander: Recognized for its significant role in global export credit agency (ECA) financing, Santander Corporate and Investment Banking had a market share of 14.16% in early 2022. It has been involved in numerous ESG-based financing deals and is noted for its contribution to renewable export finance.

4. U.S. Banks

In the United States, several banks have been identified for their excellence in trade finance and cash management, with specific banks leading in different regions:

- New England: Webster Bank

- Mid-Atlantic: M&T Bank

- Great Lakes: KeyCorp

- Plains: Commerce Bank

- Southeast: SunTrust Bank

- Southwest: Comerica

- Rocky Mountains: Zions Bancorp

- Far West: U.S. Bancorp

These banks provide a range of services that facilitate trade finance, including document management, export finance, and more specialized services catering to the needs of corporations engaged in cross-border trade. Their expertise in local conditions, financial strength, strategic relationships, and competitive pricing makes them key players in supporting U.S.-LATAM trade.

This infographic showcases key U.S. banks specializing in trade finance and cash management for LATAM trade, with a map of the United States indicating the regions where each bank excels.

Conclusion

The horizon of U.S.-LATAM cross-border trade is ripe with opportunities, especially for SMEs willing to navigate its complexities. By understanding and utilizing the right financial strategies and tools, SMEs can unlock new markets, build lasting partnerships, and drive growth on an international scale. As the global market continues to evolve, those who adapt and innovate will be the ones who thrive.